|

Recently, my 2004 Maxima transmission started having major issues. So, I had to give old Maxi up. (I’m not crying; you’re crying.) And then, the dreaded car search began. I don’t know about you, but searching for a new car is not something I have been looking forward to. Also, going to car dealerships unarmed will cause ALL the angry emoji faces. Let’s dig into this topic a little more and talk about the myths of car buying. I should go to the dealership first. No. Nope. Sorry, but no. Incorrect. I don’t know if there are any other ways to say it; do NOT go to the car dealer first. If you are financing your vehicle, they are paid bonuses based on who you are financing your vehicle with. Do yourself a big favor and do your research before you walk through those big, fancy dealership doors. What is your budget? What kind of vehicle fits into that budget? How much are you putting down? Where can you find your best rate? At ēCO Credit Union, members are encouraged to call or come into a branch to find out our rates first. We hope that your financial institution encourages you to do the same. A lower price/payment means a better deal. When you are considering financing a vehicle, you need to consider the whole picture; consider how much you will be paying back in total at the end. We all want to pay off our auto loan quicker than scheduled, but life happens and that isn’t always possible. So, let’s say you will be stuck with what you sign up for. Don’t settle for a 7% interest rate just because your payments will be below your budget each month. What if you could pay $50-$100 more a month with a lower interest rate and pay back THOUSANDS less over your term? A used car that is less than four years old is a waste of money. Like I mentioned above, a car’s value depreciates the most in the first four years of its life. However, there are some variables to consider. If you are going to a dealership, look online first to see the cars that are within in your budget and compare. Personally, I did this a month ago and came out on top. I drove about 45 minutes away to a college town; the school’s rival team has blue in their school colors. I was able to buy a 2017 car in blue for the same price as a 2013 model in any other color. Now, I can drive to any other town, and it would be worth more when I am ready to sell. Make sure to research online inventory. Don’t be afraid to ask your car salesman questions about these variables; you will be glad you did (drives away waving in blue car). Are you in the market to buy a car? We are offering a free seminar next Thursday, April 5 at the Gardendale Civic Center and would love to see you there! We will be discussing auto buying and home buying. All we ask is that you register here, as we will be providing dinner. (Make sure to check off the last choice if you plan to attend.) We hope to see you there! And, stay tuned for April as we will be celebrating Financial Literacy Month. Written by: Georgia Hux

Georgia is the Marketing Coordinator at ēCO Credit Union. She loves spending time with her husband Aaron, playing with her dog Tuff, and trying to make her house look like Chip & Jo stopped by to help.

0 Comments

It’s that time- the pollen is everywhere, the rain is falling, and the daytime is longer. Spring is here! No matter whether your home is a 600-square feet apartment or a 3,000 square feet house, this season creates a desire for cleaning up and cleaning out the dark dusty corners for a fresh start. When I look around my house, I have a hard time knowing where to begin. Do I start with the closet? Or, what about those curtains? But, the fridge shelves haven’t been cleaned in…? Here are some tips to have your house sparkling on a budget: Declutter first. Before you start organizing and cleaning, go through your “stuff” with a fine-tooth comb and find out what you use/wear/need the most. Then, donate or sell the items you decide are not worth the space they are taking up. Seek out savings. Don’t get in a hurry to buy all-new cleaning appliances. Do your research and seek out discounts. This is the season to find great deals on even hi-tech gadgets that will help you maximize your time now and throughout the year. Find practical cleaners. Right now, there are a myriad of choices for cleaning products. And, with less chemicals being a trend in our culture, the more natural brands will want (a lot of) your money for their ingredients. Why not do your own version of “natural”? Go ahead, and login into your Pinterest account. Search “DIY Cleaning Products”. You’ll be amazed at how many ingredient lists will read dish soap, vinegar and baking soda right out of your kitchen! For once, a Pinterest project that will turn out the way you want. Double on décor and storage. Are you thinking about updating your space but need a place to store some clutter? You’ll find that many companies are offering pieces that double as décor and storage for your space. I just love a good ottoman that is also efficient, right?! However, please don’t throw out those sturdy plastic bins! Use the less aesthetically pleasing pieces in less visible places to maximize your storage even more. Receiving that first paycheck is a marvelous feeling. Then, you do the math and realize there is some money missing. Wait. Who is FICA, and why are they taking all of my money? When I received my first few paychecks, I made the mistake of calculating how much money I gave to the government; I had to call in sick the next day because it made me nauseous. Taxes are a hot topic in the United States right now. With April right around the corner and a tax reform announced several months ago, there is a lot to discuss. So much to talk about in fact, we decided to commit an entire seminar on the subject! On Saturday, March 24, we will hold our third ēCO Savings Race University at the Hoover Library to discuss “Tax Return Tips”. We have invited a CPA to teach on all things 2017 and 2018 for this class. Before the class, we wanted to give you a sneak peek on a few tips we will be talking through: How do I fill out a 1040 form? The Tax Form 1040 is the U.S. Individual Income Tax Return form- reporting an individual’s gross income. The most commonly used form in the process, but how do we know which version to use and how to fill it out? It’s a very important form that can have a lot of negative repercussions if not filled out correctly. Who can I claim as a dependent? This is one of the most frequently asked tax return questions. Are you the parent/guardian of a college student or the caretaker of an elderly parent? Then, you have probably asked this question before. There are five different qualifying tests to know if your child can be your dependent for tax purposes. One of those tests is called the “qualifying child test”; it says that child either has to be younger than nineteen or a student under the age of twenty-four by the end of the calendar year. Needless to say, there are many details to cover at our March 24 seminar! How will the 2018 tax reform affect me? There are so many questions! Some of the most popular topics with the next tax reform include: percentages, deduction options, child tax credit, new home owners, and more. We will go over all of the changes, so you will know exactly what to expect this time next year! The more you know, the more you can prepare. We are excited to host a class on tax return tips in 2018, and we hope you are too! This is an absolutely free class in the Shakespeare Room of the Hoover Public Library. It will begin at 10:30 a.m., and we will provide snacks as well! If you are waiting to file this year’s taxes or you are worried about next year’s, make sure to stop by next Saturday morning! To register, click here. Written by: Georgia Hux

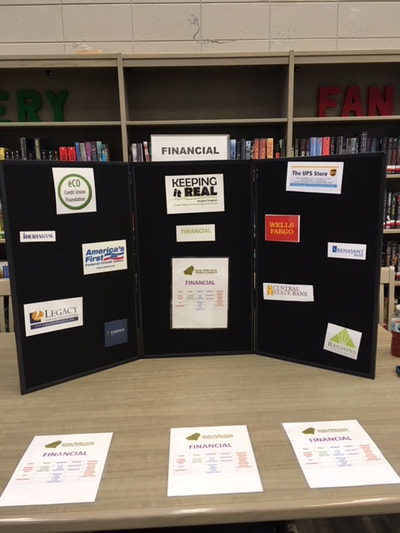

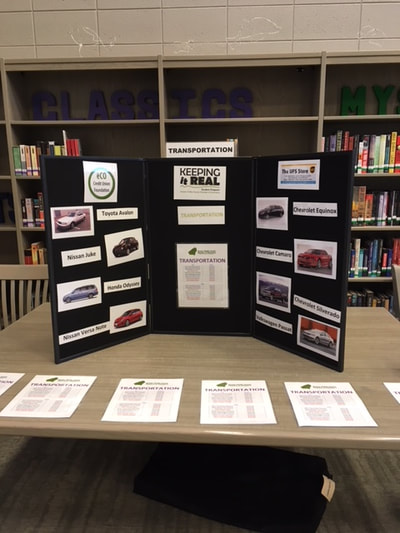

Georgia is the Marketing Coordinator at ēCO Credit Union. She loves spending time with her husband Aaron, playing with her dog Tuff, and trying to make her house look like Chip & Jo stopped by to help. For the 2017-18 school year, the ēCO Credit Union Foundation partnered with the Greater Shelby County Chamber of Commerce for a program called Keeping It Real. We were excited to be one of the sponsors this year for such a worthy cause! Keeping It Real simulates a real-life scenario for ninth graders in Shelby County, Alabama; these scenarios give the students careers, education, money, and a family. Then, they are responsible for visiting twelve booths to either earn money or pay for something. Below, you’ll find pictures of both the Transportation and Financial booths. Some of my favorite comments from students include: “Do I have to buy insurance?” “Why are kids so expensive?” “I need to go home and thank my parents!” “Do I have to save money?” Hearing their epiphanies make me envious that I did not have financial education in high school; my first car insurance bill may have hurt a little less if I had known the costs real-life throws at you! Being involved in this program leads me to this question: What are you doing to prepare the next generation with financial education? So many kids I have talked to with Keeping It Real have zero knowledge of the costs of life. And, I believe if adults were more transparent about their finances, the next generation would be more equipped with the tools to make better financial decisions than we have! For instance, when we are at the grocery store with our kids, what if we showed our kids the difference between generic and name brands? What if we showed our nieces and nephews how much our car insurance is and explain why we must purchase it? Maybe, we can share why it is important to pay ourselves first (or save) when our paycheck comes into our account. I am challenging you to be more intentional with the middle and high school-aged students in your life in sharing the reality of how expensive life can be and why it’s important to learn now! And, if you are a teacher or want to refer some material to a teacher, we provide free, no-strings financial education curriculum through the ēCO Credit Union Foundation. Simply, click here to find out more and order for your classroom. We are excited to equip legacies to come with information to make to better financial decisions! |

RSS Feed

RSS Feed