|

First and foremost, THANK YOU to everyone that donated to our cause of #GiveFinancialFreedom on #GivingTuesday. We are thankful for each dollar because we know how our dollars are multiplied through financial literacy! But, we are not finished with our cause. It’s the end of the year, and it’s your last chance for tax write-offs for 2017. But, don’t write your check yet! We want you to know how your money will be spent, and we hope that is reason enough to give a year-end gift to the ēCO Credit Union Foundation for 2017. We like to break up the resources we provide into two categories: Schools & the Community. With that said, here is how we spend the money graciously donated to us: Schools -Banzai: This is a curriculum provided free-of-charge to schools in select areas; Banzai enables teachers to easily obtain financial education curriculum from middle school- to high school-aged students. -Classroom Seminars: We contact or are contacted by educators who would like a more in-depth financial education experience for their students. Volunteers from ēCO Credit Union will come and teach from prepared lessons, including Finance 101 and Life after High School. (We plan to expand this program even more in 2018!) -Keeping It Real: Hosted by the Greater Shelby County Chamber, the Foundation is a co-sponsor of this event for high school freshman. Each student is taught about a budget and given a hypothetical life scenario, where they are given a career, salary, and other information. Then, they visit 12 booths where they spend their money on things like insurance, housing, utilities, and more! -Classroom Grants: Teachers are given the opportunity to apply for a grant through the ēCO Credit Union Foundation. The requested money granted has to be used for financial education or material that will increase financial literacy in the classroom. If you know an educator that would be a perfect candidate, nominate them or encourage them to fill out the application found on our website! Community -EverFi: In January 2018, we are excited to launch an online financial education tool that will allow anyone to have access to curriculum completely free of charge! Topics will include everything from budgeting to retirement planning. -Community Seminars: Our community seminars cover various topics, which are also free of charge to the public. We will invite speakers for a series throughout January-April at various locations across the Jefferson and Shelby County areas. Also, we are always open to requests if a group would like for us to come in and speak on a particular topic. -Community Grants: This year, we began supporting community events that are encouraging financial literacy in their sphere of influence. If you know a community leader that should apply, make sure to share our website with them or send us an email with their contact information! -Scholarship: Each year, we award one scholarship to an adult that is returning to school to further their career or change career paths. (Did we mention the scholarship application is available?! Click here for the application.) Now, if you are convinced that we will put your money to work in 2018, don’t hesitate to pull out that checkbook now! We would be honored to be a part of your charitable donations in 2017. Simply, go to the top menu and click the Donate page to find out all of your options to give. AuthorThis blog post was written by Georgia Hux, Marketing Coordinator at ēCO Credit Union. She is wife to Aaron, fur-mom to Tuff, and thinks Joanna Gaines is her best friend.

0 Comments

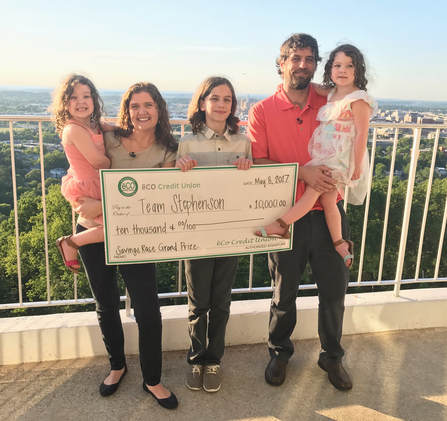

Could this week get any better? From the 3-day work week to the fellowship on Thursday, this week just makes the world feel right. And then abruptly, on Friday, our world gets bombarded with the craziness of “ONE DAY ONLY” and “BUY THE ENTIRE MALL FOR ONLY $50”. (Okay, maybe that last one was a little exaggerated… or was it?) As soon as Black Friday begins, the peace of this week leaves. Suddenly, this holiday takes a turn to “gimme”. How do we so quickly go from gratefulness and peace to selfishness and greed? Well, I think have the answer--give more, get less. Sure, everyone needs to buy gifts and find a great deal on those gifts to afford the mounds of presents that are expected from us (at least in the USA). Black Friday and Cyber Monday help us with the effort to save a few bucks during the holiday season. However, I am convinced that we lose ourselves in the process of the third BOGO offer. Some of the most heartfelt, cherished gifts I have received or given were made or bought for under $10. It truly is the thought that counts. On November 28, 2017, we will join #GivingTuesday at the ēCO Credit Union Foundation to promote giving instead of getting this holiday season. Our cause supports increasing financial education in the greater Birmingham area so that we can become better customers, givers, and citizens in the community. Everything we do reflects our cause, from giving an annual scholarship to an adult trying to further their career with higher education to going into classrooms and teaching middle schoolers the difference between a checking account and savings account. It is our mission to make certain that our donors see their money used over and over through the resources we provide, so that one day their daughter, grandson, or neighbor will be affected by our work! This Thanksgiving, reflect on where your heart is when you sit down to make your Christmas list. What is the intention behind each gift? If it’s to impress that person, you likely won’t. If it’s to impress the people that will be watching, it likely won’t. Instead, what if you gave toward a cause or organization that you know will mean more to the recipient? Last year, I gifted a donation and the reaction was worth not buying the meaningless jewelry I had originally planned on. Let’s make #GivingTuesday one for the books in 2017. If you would like to give to our cause to #GiveFinancialFreedom, we would love to have you join us! You can give online (eCOcuFoundation.org) or give in any ēCO Credit Union branch location. Stay tuned for an exclusive giveaway for our Giving Tuesday donors only! Written by: Georgia Hux  Written by: Danielle Stephenson/Team Stephenson, ēCO Savings Race 5th Edition Winners When we applied to the ēCO Savings Race, our goals were focused on paying off as much debt as possible. I am not ashamed to say it -we were financially illiterate. Our “budget” consisted of checking our account every time a bill came in to make sure we had the money to pay it. This process caused us to always spend more than we made, which led to credit card debt and monthly fights about money. Due to the actions of the ēCO Credit Union Foundation, we were able to pay off $28,070 of debt in only 9 months. We were able to cash flow items totaling $3,148, and we were able to save $2,800 for our emergency fund. However, it was the action of giving $2,838 that changed us the most. How in the world did a Foundation help us do all that you ask? The ēCO Credit Union Foundation supplied our family with Dave Ramsey’s Financial Peace University; it was this experience that started the transformation in who we were and how we viewed our finances. We were also given the opportunity to attend ēCO Savings Race University; these are free seminars, open to the public that focus on teaching financial skills in many different areas. We learned about creating a budget, credit scores, tips for buying a home or automobile, retirement, wills and trusts, and my favorite- couponing and meal planning. By the end of each class, my hand hurt from vigorously taking notes. Using all of the financial information we learned, we were able to put systems into place that allowed us to pay down debt, save money, and most importantly- give money. During those 9 months we became regular tithers, something we had not done consistently in our 13 years of marriage. We were able to buy groceries for a wonderful family in our church who we met through the foster child outreach program. We donated an automobile we were not driving to a local foundation. We purchased food for a food pantry, and we packed a box for Operation Christmas Child. You may be wondering how giving away our money changed us more than paying down our debt. The best way I can explain it is that as we shifted our focus from our own needs, to the needs of others, we started understanding what it means to be happy. As we began to adopt a lifestyle of generosity, we began to feel more contentment within our own lives. This led to fundamental changes in each and every one of us- and let me tell you, it is a beautiful thing to see in your children. This year, we packed four boxes for Operation Christmas Child, and it is now our favorite holiday tradition! The ēCO Credit Union Foundation is a perfect example of focusing on the needs of others. Their whole mission revolves around helping the community raise their level of financial literacy. Why do they do this? They do it because they care. They do it because they understand that knowledge is power, and financial knowledge can change people’s lives; it definitely changed ours. They can’t do it alone, though; they need help from others looking to give. Please consider participating in Giving Tuesday on November 28, and make a donation to their noble cause. Don’t forget to spread the word on your social media with #givefinancialfreedom. Your donation will make a difference in your community and in you as well. If you have any questions for Danielle about anything she discussed in this post, or if you have questions about your finances, don't hesitate to comment below! We would also love to hear if you're enjoying these posts and what financial topics interest you the most. We want to write what about what matters to you! Thanks for reading. “Jingle bells, Jingle bells…” It’s the holiday season, whether you’re ready for it or not! (Yes, I’m serious Clark.) And, the end of November hits our wallets pretty hard. Not only is there Thanksgiving dinner to prepare for, but there are two days that are causing us to stop and spend more money than any other time of the year-- Black Friday and Cyber Monday. And, most people forget (or choose to forget) the Tuesday following which encourages giving after all of that spending.

#GivingTuesday is an incredible chance for nonprofit organizations all over the world to share with you why their cause is worth giving to. Let’s be honest: we focus a lot of time on material things during this time of year. But, we’re missing the point. This season is all about GIVING. At ēCO Credit Union Foundation, we think financial literacy is a cause worth supporting! Financial literacy allows for students and adults to know how to handle money and be a better customer, citizen, and giver. We have watched lives & legacies change because of the financial education being provided through the Foundation. We have watched students grasp why it’s important to save and how much bills and monthly expenses can add up in the real world. We have watched adults learn how to pay off their debt quickly and save for something that is life-changing. Financial literacy is not a cause that you hear about often; it’s not popular to talk about financial situations and money. But, we have seen a great hunger from our Birmingham communities to learn more about money, and we are passionate about serving that need. We are challenging our followers to give just $1 on Giving Tuesday, November 28, and then turn around and share how they chose to #givefinancialfreedom during this season of giving. |

RSS Feed

RSS Feed