|

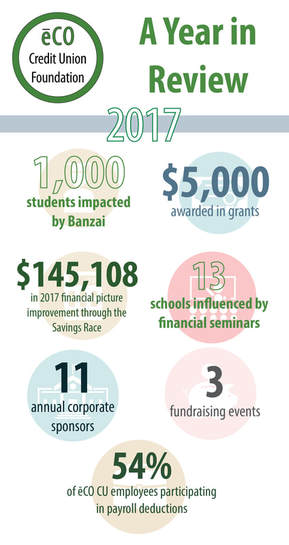

A lot happens at the end of the year- people are taking back gifts they didn’t ask for, accounting departments are scrambling to get in those last numbers, and Christmas trees are coming down. But, what are we missing? What about nonprofit organizations? Lucky you, we are a 501(c)(3) nonprofit, so we have some great advice. At the end of the year, nonprofit organizations are in a unique position. Not only are we working to start off the next year ahead, but they are able to help others with tax return deductions. Did you know that giving a donation now will pay off in just a few months when you begin filing your 2017 taxes? We would encourage you to find a nonprofit that exemplifies the passions you have. However, chances are that our passion at the ēCO Credit Union Foundation may match yours if you are reading this right now. We want to be very open with you. We would be honored to be the nonprofit organization that is chosen to receive your gift in these last few days of 2017. Let us show you some of the impact our donors have had in the greater Birmingham community just in ONE YEAR. We are so proud of the accomplishments 2017 has given to us. But, we are nothing without our donors. Literally. We are at $0 without our donors. I don’t know if you’ve heard, but $0 doesn’t get you very far (even if you are a master at budgeting). Would you consider making a donation to increase financial literacy in the greater Birmingham area in 2018? Click anywhere above or below where you see the word “Donate” to be routed to our PayPal account. We are watching financial education change lives- young and old, upper and middle class, every race and background. Consider giving today to change legacies to come.

(P.S. If you’re still on the fence about giving to the Foundation, just click the “Donate” tab and watch the video. Let the people who have benefited from donations tell you how much your donation matters!)

1 Comment

Debt is not a good word, right? And, unfortunately, this time of year brings the ugliest of the debt conversations and thoughts. During the 2016 holiday season, 24% of shoppers spent more than their budget and another 27% did not even have a budget. In 2017, those percentages are expected to increase. Where are we going wrong during this season, and how can we prevent excess debt at the end of the year? (So glad you asked!)

1. Start planning now for next year. Open up a savings account JUST for Christmas. Ask your financial institution if they have any accounts specifically for Christmas that will give an incentive to keep the money in the account throughout the year. 2. Make a list, and check it twice. You can’t expect to stick to a budget if you never had one to begin with. Before the season started, I wrote down each person that I needed to get a gift for. Then, I put an amount that I hoped to spend on each person. I compared that total number with the amount budgeted and had to adjust some numbers to make sure the totals matched. It has helped me tremendously with knowing how much each gift should cost. 3. Look for low interest. If you absolutely need to borrow some money, look for lower interest rates so paying back debt after Christmas is not so painful. Credit cards will rack up interest over 20%! Make it a goal to not go over a 10% interest rate for your holiday purchases. 4. Sell a few things you aren’t using. Do you have a Wii sitting in your basement? Or, is there a recliner that is not getting used? Not only do we all need a few extra dollars during this season, but we also are all looking for a deal. This is the perfect time to sell gently-used electronics, furniture, jewelry, appliances, or clothes. It’s a buyer’s and seller’s market! Try to get to January 1 with little to no debt from the holiday’s this year. If that plan is already ruined, how can you plan for December in 2018 better than you did in 2017? Make sure to follow us on Facebook to find out how we are planning to have an even better 2018! It’s already December?! The year is almost over, and we are all simply trying to survive this holiday madness. But, don’t forget that December is your last chance to improve your tax return for 2017. As we all know, tax reform is a hot topic right now. Let’s make sure that we are over-prepared going into 2018 to file taxes in the Spring. To help, we have four tips that we believe will help with closing out this year on a good note: 1.Clean out your closet. Do you really wear all of those clothes? Really? Look in your closet, and be honest with yourself. For most basic clothing items, the resale value is minimal. Go ahead and fill a bag with the clothes you are not wearing often or at all. Make a tally of the items you are giving away. Then, take them by a local thrift store or charity. It will be much more gratifying giving away gently used clothes to someone who really needs them than making a few bucks off of a sale. Also, don’t forget to ask for a receipt when dropping off. 2.Write a check to a nonprofit. Nonprofit 501(c)(3) organizations need your help, especially at the end of the year! Nonprofits do not earn any money, and the only way they bring in money is by generous donors. Find one to two nonprofit organizations that have a cause aligning with your passions and/or beliefs, and write a check to them before Christmas. (We know a great one to give to… just click “Donate” above to find out how to donate to us!) You will either automatically receive a receipt, or you can request one for your tax records. This charitable gift will help with your tax deductions for 2017! 3.Out of your pocket? Teachers can especially benefit from this one, but really, anyone can benefit from comparing their personal expenses with their job day-to-day duties. There is a special educator’s tax benefit, allowing up to $250 to be deducted from income when out of pocket expenses are excessive . However, if working from home or having to leave the office for your job is something you do, think about the bills you are paying. If you are driving and using phone data for a GPS or you work from home and use personally-payed electricity (and are not being compensated), these items can be used as a write-off. Make sure to start calculating these bills/expenses now! 4.Did an apple a day keep the doctor away? Or nah? Many of us end up at some kind of doctor at least a few times per year. However, some of us may have had an extraordinary year of medical expenses. Did you know that if your medical expenses exceeded your income by 10%, then, your healthcare expenses are eligible as a tax write-off? Don’t let this one pass you by! We hope this information is relevant to your situation! And, if you have any questions, please find a licensed tax advisor or CPA in your area. I am not a tax professional, so please be advised by someone that is! |

RSS Feed

RSS Feed